Gary Rackliffe

Vice President, Smart Grid Development, ABB North America. Gary Rackliffe was appointed to VP of Smart Grids North America in May 2009. He leads ABB's Smart Grid initiative in North America, including business development, strategic partnerships, and ABB’s marketing and product strategies. Gary has over 25 years of industry experience in both transmission and distribution and has worked for ABB for 19 years in Raleigh,NC in several positions. He was previously the VP of Marketing and Sales for the Northeast and Mid-Atlantic sales region.

Popular Posts

- Asset health management in the smart grid era

- 'Big Fish' in an emerging smart grid market

- Regulatory Impact on Electric Vehicles

- Leveraging technology to drive energy efficiency and conservation

- Smart Grid Investment Trends: Follow the money, Part 1

- “Where’s the Big Data?”

- Why is battery energy storage such a hot topic?

- Finding Gold in Asset Health Management

- Looking forward to 2013

- The Smart Grid Killer App

A North American perspective on smart grid trends and technologies.

Friday, December 2, 2011

Smart Grid – A Triple-Helix Growth Model in the Research Triangle

Monday, November 21, 2011

Regulatory Impact on Electric Vehicles

Electric vehicles are frequently cited as an example of two aspects of the smart grid. First, they represent a major new load source that, unlike others, is mobile. Second, they represent an opportunity to leverage smart grid technology to mitigate the impact of that load through “smart charging.”

So EVs are, at least in principle, driving the development of smart grid but what’s driving the development of EVs? In a word: regulation.

Friday, November 11, 2011

What I didn’t hear at the GridWise Global Forum

But how do utilities engage customers on something that the industry itself has such difficulty defining? More often than not, the benefit of smart grid for consumers is described in terms of “savings” both in terms of energy—with its implied virtue—and more importantly, money.

Such was the case this week at the GridWise Global Forum in Washington, DC. The two-and-a-half day conference opened with remarks by US Secretary of Energy Steven Chu and included a lineup of speakers from a range of companies and institutions, several of whom repeated the savings mantra.

Wednesday’s session on “Smart Grid and the Regulatory Landscape: Evolution or Revolution” featured a panel including current and former regulators as well as a policy officer from the telecom industry. Verizon’s Kathy Brown emphasized how important customer choice is/will be to the success of smart grid investments, specifically in who people buy their power from.

This remark, which Brown reiterated more than once, struck me as profoundly uninformed. Was she not aware of the experiments in retail choice undertaken by so many states that produced so few customers for alternative suppliers?

Which brings me to my point…

I would submit that the reason most (residential) customers didn’t switch when given the opportunity is the same reason most of them now have such tepid interest in what smart grid can do for them. They don’t care because they have never cared. They’ve never had to think about their electricity supply, and asking them to engage with their utility via demand response, rooftop solar or time-of-use rates presupposes that they have an interest in power in the first place. They simply do not perceive a need to change.

Even if we put this conundrum aside and focus on the “savings” argument, the industry still has a major hurdle to overcome.

Residential customers on traditional rate schedules are insulated from the true cost of power. In addition, the customers who would stand to save the most from smart grid (i.e., those who consume the most) are the least likely to feel the pinch of a high utility bill. A 20% savings simply doesn’t create enough of an incentive to *start* thinking about electricity.

Now, if every residential customer were placed on a TOU rate, it might begin to break this customer inertia. But of course that would not be advisable, and as New York PUC commissioner Maureen Harris noted, it would also be illegal in her jurisdiction.

So, we come around again to where we began: how do you get someone to care about a service that they have taken for granted their entire life? How does the provider of that service—bound by law to supply it reliably, safely and affordably, forever—convince the consumer that they even have a role to play in the process?

I didn’t hear a response to this question at the GridWise Global Forum, but I don’t mean to suggest that there is a straightforward answer. I certainly don’t have one. But I think it’s clear that we need to move beyond the “save money” argument and start thinking about how to first get people interested in where their electricity comes from. Once we have their attention, we can begin to think about how to frame the benefits of smart grid in terms that will resonate with customers.

Tuesday, November 8, 2011

Smart, smart, smart….so what?

Who?

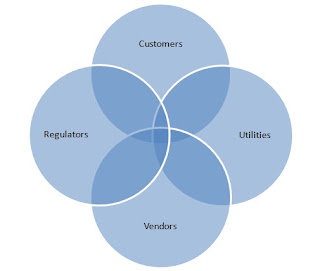

We have been talking about smart grid for a while now. We still don’t really know what it means and how to handle it. But we know the benefits or rather we have our own expectations of what these benefits should be. For start, these benefits depend on whom you ask. If you ask consumers (people who pay the electric bills) the expectation is to lower the cost of electricity or be able to better manage their home resources. Well, for some (growing number) of them it is also to start protecting the environment, be more green, more energy efficient but... not at the expense of higher cost of electricity (at least not more than maybe a few percent). If you ask the electric utilities, they are probably least certain of what the smart grid would bring them. Of course, the underlying principle would be to lower the operating cost of their systems, which would mean higher profit margins. They also hope that they could avoid building new generating plants, or defer some of the major investments in replacing the aging infrastructure. But this is not the end. Ask an equipment vendor, and their expectation from the smart grid “movement” is to promote, implement, and sell new technologies. The technological advancements in the power and especially in the IT industries are truly impressive. Just think of what you can do with your cell phone and how inexpensive (relatively speaking) they became. And all the new software that lets you use internet for your banking, blogging, facebook’ing, grocery shopping and alike. Finally, there is also yet another player in the smart grid arena, the regulators (read: government). They represent the interest of the public, the society at large and their mission is to make the smart grid the greener grid, more sustainable, efficient, creating more jobs, and be more environmentally friendly. It does not take too long to realize that these four groups have often different interests. What is friendlier to the environment might not be necessarily lower cost, to the contrary. The new technology, although it might provide more functionality and better performance, might actually burden the electric utility by overwhelming it with data.

What?

So, what we see in the smart grid arena now is a mix of ideas and objectives, often contradictory, or at least seemingly contradictory, that are being funneled into actions. Some utilities are implementing Volt-Var Optimization (VVO), many see a great opportunity in asset health management (see Gary’s blog last week), many utilities have already started automatic meter reading (AMR), advanced meter infrastructure (AMI), meter data management (MDM) and demand response programs that more tightly connect the utility and the consumer. There is a great interest in distribution automation, where many devices on the line can be coordinated, exchange information, and act much quicker when system disturbances occur. Power outages can be isolated and shortened providing a high level of service. System-wide software platforms allow some utilities to compute the power flow and manage, proactively, the balance between loads and sources. Examples are endless. There is no shortage of ideas or concepts. Which ones will catch on, survive and thrive… we’ll have to wait and see. At the end it will be up to us, the society, to accept and embrace what is the best for the environment, for us, and for the future generations.

When?

When?Is smart grid being used as a panacea to all the ills of the electric energy industry? Well, unfortunately the answer is yes. And that may not be a bad thing to do, considering the opportunities that are out there. But, the process of modernizing the grid (read: implementing smart grid) will take a long time. Let’s be realistic, there is no end date for smart grid implementation. There is no magic “flip the switch” and the smart grid will be on. There will be no ceremony celebrating the occasion. If one looks at the utilities in the United States and considers how many years the industry was stagnant and complacent, claiming that it was the most advanced electric power system in the world, it is clear that it would take at least that long to get back on track, catch up with what should have been done a long time ago, and move to the next phase. So, we are talking about a generation or so. This kind of long range process is often impossible to fully predict or control. With this time horizon one can only speculate what will happen and which direction the society will take. But we have to start somewhere. The greatest accomplishment of the smart grid that I can see (forget the new power planning software or a new sensor, or a smart meter) is that we all realized that something has to be done. We might have different views of what it is, but the change is needed, and it will happen. It might not be 100% clear when and where, but the wind of change has started now. And this is an opportunity for all of us, customers and providers, vendors and consultants, students and professors.

Monday, October 31, 2011

Finding Gold in Asset Health Management

Why is asset health important? Utilities are usually interested in asset health for two reasons. The first reason is that utility infrastructure is aging and aging assets can challenge utilities in achieving performance and reliability metrics. The utility workforce is also aging with many employees becoming eligible to retire over the next five years, taking valuable asset knowledge and expertise out the door.

The second reason is that utilities have limited resources and personnel and there is always pressure to reduce operations and maintenance expense since this line item directly impacts the utility bottom line. Asset health solutions that can be capitalized and that drive savings providing a return on investment can be attractive to utilities.

The asset health solutions that utilities are implementing today are end-to-end solutions that support the business process of maintaining assets to meet reliability, performance, and compliance goals. The end-to-end solutions include asset knowledge and expertise; sensors and monitors; communication gateways; data integration, archiving, and storage; equipment performance models and algorithms; analytics and dashboards; and integration to asset and work management for supply chain management and work execution. Many utilities have sensors and monitors in the field and most utilities have enterprise-level systems for asset and work management, but there are often gaps in the end-to-end work integrated workflow.

The most frequent gap is the business intelligence module which is essential for asset health decision support and managing asset data. This module processes data from multiple sources such as sensors, SCADA historians, and test and inspection reports. The performance models and analytics assess the health of the assets and provide the information that: triggers alarms, initiates condition-based work orders, feeds asset health dashboards, and drives the decision support processes. In addition to alarms and the information needed to determine the health of assets for condition-based maintenance, this BI module also enables a transparent process for life-cycle management of assets – determining when to retire and when to refurbish or up rate assets.

I keep thinking about the comment from one utility executive. With a bit of frustration, he stated that his wife’s car has better health monitoring than his transmission system assets. Going back to the quote from Ron Ploof, we can improve how we mine the asset data gold that we have.

For additional information on asset health, here are a couple of links. The McDonnell Group did a study on utility asset health and their whitepaper can be found here. An ABB article on life extensions and safety upgrades for aging distribution equipment can be found here.

Wednesday, October 19, 2011

Public vs. Private: the Smart Grid Communications Debate

Guest post: Matthew Knott, ABB

One of the few aspects not up to debate in the smart grid market is the importance of a communications network. In order to take full advantage of the benefits smart grid technologies have to offer, the utility’s approach must be comprehensive. Therefore, communications function as the backbone of the smart grid enabling complete interoperability between new and existing infrastructure and proving new business cases.

In terms of communication for the smart grid, this is where universal agreement ends and the debates begin. One major topic of discussion in this realm is the use of public versus private networks. This subject has been discussed in conferences, webinars, forums, and various other media outlets throughout the industry. After listening to the voices of many industry experts, it is clear there are some key advantages of each option to consider before making a final decision:

Public

Bandwidth – Most utilities are just at the cusp of the new data explosion that will help optimize the grid in terms of increased efficiency and reliability. However, these benefits are going to require higher bandwidth to allow for real-time reporting of energy consumption to provide direct load control for reserves or peak shaving. Public networks can offer the bandwidth needed for implementing smart grid applications at a large scale.

Reliability/Maintenance – With public networks, ownership is not the concern of the utility. Should power and communication equipment go down in the case of a bad storm, utilities can concentrate on their core competency, restoring power back to the consumer. At the same time, the public cellular carrier will do what they do best, bring communications back online. Without a public network, utilities will undoubtedly feel pressure when it comes to maintaining communications.

Simplicity – Along the same lines as reliability, with public network infrastructure already in place, the utility can easily utilize this in developing effective pilot programs in a shorter period of time.

Private

Security – This is perhaps the most emphasized advantage of private networks. With control of the network, the utility has oversight to limit the number of entry points in the network making it easier to identify and prevent any threats. Moreover, the design of the private network can be implemented to directly address the security needs of mission critical applications.

Coverage – The motivation behind communication coverage differs between public and private networks. Utilities require more ubiquitous coverage over a territory rather than based on the number of consumers since communications are also important with remote equipment along the distribution grid such as capacitors or reclosers. Thus, private networks have more flexibility to provide the necessary coverage

Lifetime Cost – Private networks do require additional capital to put the infrastructure in place, however, in the long term private networks can be more cost effective due to lack of ongoing monthly subscription costs. These costs only increase as additional points are introduced into the system. This allows the typical private network to have a shorter payback period.

Overall, the best response to this debate, in my view, is one that we’ve all heard before, it depends. Each utility has a different variety of customer segments and must position them accordingly. I am finding that, most often, the way to best utilize the advantages of both public and private networks is to develop a hybrid solution allowing utilities to effectively address their customer’s needs. For example, a utility’s rural customer segment with poor cellular coverage would not be best served with a complete public network solution. Having a deep understanding of current operational capabilities, current/future smart grid approach, and the accurately segmented customer base will ensure the correct path is carved for developing and implementing a successful communications strategy.

Thursday, October 6, 2011

Incorporating IEC 61850 interoperability into Smart Grid systems

There has been heightened interest in the IEC 61850 interoperability standard as a strategy in deploying smart grid systems. Those familiar with the standard realize that this is a comprehensive set of standards with the goal of providing better interoperability between a variety of IEDs (intelligent electronic devices). True interoperability promises great reductions in cost for designing, replicating, modifying, and implementing systems.

Many mistakenly refer to IEC61850 as a protocol. While protocol is an important element, the standard actually goes much deeper. When many people hear the word protocol, they see this as requiring a wholesale change out of existing communications networks and devices. This can become overwhelming when in fact there are options that allow implementation of IEC 61850 in increments. This allows users to obtain immediate benefits while building confidence.

A few examples include:

- 61850 GOOSE messaging may be used between IEDs to eliminate physical wiring and increase speed of interaction while continuing to use DNP to communicate upwards to SCADA and higher level systems where slower communications updates are acceptable. This opens new applications for end users because of the GOOSE high speed capability but does not necessitate a change in the SCADA communications infrastructure.

- Station Bus protocol (IEC 61850-8-1) can simplify the interface between IEDs, HMIs, etc. within the substation network while continuing to use a DNP interface to SCADA. Gateway devices are on the market which allow a combination of station bus compatible IEDs to coexist with legacy IEDs communicating via other protocols such as DNP or Modbus. The gateway can therefore provide the 61850 interface to other systems.

- As Process Bus (IEC 61850-9-2) devices become readily available, the opportunity to eliminate copper wiring between CTs and IEDs provides tremendous savings opportunities but could be done independently from Station Bus implementations.

The variety of 61850-based solutions and their benefits is becoming more apparent. Many technical papers now exist describing specific implementations of IEC 61850 based systems, while numerous consultants and users have set up IEC 61850 interoperability labs to determine what applications they will be implementing into production.

As the market is rapidly adapting this standard as a key element of their smart grid systems in order to begin achieving the benefits, those not embracing this will find themselves at a disadvantage.

Monday, October 3, 2011

Interoperability and Cyber Security

This week I moderated a panel discussion at an ABB sponsored event for utility executives that addressed interoperability and cyber security issues. (Read more on this panel at Greentech Media.)

We planned our event and discussion a few months ago, but the timing coincided with the release of position statements from the GridWise Alliance and its Interoperability and Cyber security Work Group (ICWG). This month, the ICWG completed position statements on both interoperability and cyber security. In addition, the ICWG is currently developing the agenda for a briefing on Capitol Hill that will educate members of Congress and their staff on the work the industry is doing address cyber security issues.

GridWise Alliance Principles for Grid Interoperability

The position statement that provides the GridWise Alliance principles for Grid Interoperability is available here.

Key points from the statement include the comment that “a more interconnected, automated, and information-rich electricity delivery system provides the opportunity to deliver a safer and more reliable interoperation, and to mitigate threats to the grid and electric user’s privacy from accidental and intentional harm…. The Smart Grid Policy Center defines interoperability as ‘the seamless, end-to-end connectivity of hardware and software from end-use devices through the T&D system to the power source, enhancing the coordination of energy flows with real-time information and analysis.’1 The GridWise Alliance believes that with sound planning, thorough design, and coordinated execution, a safe, secure, and reliable smart grid can be achieved.”

Outlined below are the key principles endorsed by the Alliance for interoperability.

1. Promote stakeholder neutrality and utilize non-discriminatory language.

2. Minimize intellectual property encumbrances.

3. Develop standards based on protocols and support formal testing.

4. Incorporate plans for ongoing evolution.

5. Create standards that are cost-effective to implement, enhance, and maintain.

GridWise Alliance Principles for Cyber Security

The position statement that provides the GridWise Alliance principles for Cyber security is available here.

The Cyber security position statement notes that “from smart meters to smart appliances to more intelligent control of distribution, transmission, and generation, an advanced grid offers the potential of improved utilization of all generation and storage resources, increased operational efficiency and reliability, and enhanced opportunity for customers to make choices about energy use…. A more interconnected, automated, and information-rich electricity delivery system also provides the opportunity to deliver a safer and more reliable interoperation, and to mitigate threats to the grid and electric user’s privacy from accidental and intentional harm…. The GridWise Alliance believes that with sound planning, thorough design, and coordinated execution, a safe, secure, and reliable smart grid can be achieved.”

The five key principles endorsed by the Alliance for cyber security are:

1. Involve all stakeholders and take full advantage of and be aligned with existing recognized processes and work.

2. Utilize a comprehensive risk management approach.

3. Provide clarity to all stakeholders.

4. Construct a cyber security framework that is focused specifically for electric grid applications.

5. Create and adopt uniform verification and test procedures for standards and guidelines.

If I go back to my panel discussion again, the two panelists were Paul Molitor from NEMA and Mark Browning from ComEd. We did not issue any position statements on interoperability and cyber security for the smart grid, but Paul and Mark made some great points on the two issues. For interoperability, we discussed the key concepts in the Smart Grid Interoperability Panel (SGIP) process for Testing and Certification:

1. The process is ISO-based

2. Best practices for governance, lab qualification, technical design, and cyber security are incorporated

3. The process defines the roles and responsibilities for the Interoperability Testing & Certification Authority (ITCA)

For cyber security, some of the key learnings and observations included:

1. Clarity of roles and responsibilities is critical

a. Information Technology (IT) vs. Operational Technology (OT)

b. IT vs. Business

c. Vendor Relationships

2. Security design and security support

a. Design security in from the beginning

b. Security designs must be end-to-end

c. Plan for the on-going care and feeding – upgrades, patches, and life cycle investments

d. It is not just about technology – proper controls are a necessity

3. Resources

a. Hiring and retaining qualified security resources

b. Volume of work continues to grow (e.g. NERC CIP, Smart Grid, etc.)

To wrap up, I am not a member of the GridWise Alliance ICWG, but I am a member of the GridWise Alliance Implementation Working Group. We are working on a white paper that addresses the smart grid value proposal which should be released in November. I’ll have some comments on that work when it is released.

Thursday, September 22, 2011

Observations From Gridweek 2011

In his latest blog post, Gary concluded that there is no one "Killer Smart Grid App", but instead a number of apps all equally important in the efforts of creating a smarter grid. Last week, I had the privilege to attend Gridweek 2011 and this point was extremely evident as discussions on topics ranging from distribution automation to EV charging and energy storage were everywhere to be found. One area in particular that sparked my interest was home energy management. Both the exhibit hall and sessions were buzzing with topics such as energy management technology, consumer empowerment, and residential demand response programs. It is evident that stakeholders in the Smart Grid space have expanded their focus beyond the meter to include end users, a very important piece of the overall equation.

In the area of home energy management technology, the exhibit hall featured companies like Opower, who doesn’t sell physical products at all (although the company announced a partnership with Honeywell during the show) but instead offers software and analytics that help utilities (57 of them currently) better interact with customers. Tools such as home energy reports, online tools, and energy alerts (involving the ever important smart phone) help customers become more energy efficient, assist with daily and seasonal utility peak reduction programs, and are said to make consumers happier. Another company featured in the hall, Energate, offers products (such as smart thermostats, in-home displays, and wireless communication gateways) as well as software, all part of the company’s Home Energy Management Suite. The technology allows consumers to manage their energy use and reduce peak demand, and provides utilities the ability to implement demand response programs. These weren’t the only companies in the home energy management space present in the exhibit hall, with other companies present including Digi International, Comverge, and Tendril.

Behind all of the excitement of these cutting edge home energy management products and solutions, there was an underlying question that came up during multiple sessions: "How do we get customers excited about and interested in this technology?" Time and time again, the answer involved creating value for the customer without overcomplicating the matter. It is critical that the customer understands how home energy management benefits them, and not the utility. These benefits could vary by consumer, but could be anything from a few dollars saved on their monthly bill to the convenience of having automated systems in the home. One point made during the show that I thought was great is that customers can be conscious, smart, energy users without ever knowing what a kW is! With that said, another question that came up frequently was "What about those customers who are against this technology due to various concerns?" Smart phones have shown us that these concerns (such as privacy or potential health issues due to radio frequencies) seem to disappear once you are able to show value and create consumer dependency on a product or solution.

While it is evident that Smart Grid stakeholders still have quite a bit of work to do in the home energy management space, it is encouraging that this was such a hot topic at Gridweek 2011. Creating value for the consumer will be important and helping consumers to realize this value will be critical. It will be exciting to see how home energy management evolves as it becomes more of a priority in creating a smarter grid.

Friday, September 16, 2011

The Smart Grid Killer App

Last year, Eric Wesoff for Greentech Media said that “demand response is the first smart grid killer app for industrial and large commercial customers. The killer residential energy application engages the energy consumer and places the consumer in a partnership with the utility. It's not easy, it's not sexy and it doesn't look like a shiny new smart meter. But it creates a value that the majority of customers understand. And we haven't quite found it yet.”

Apparently FERC Chairman Jon Wellinghoff did find his killer app last year. In an interview with Smart Grid Today, he said that “providing consumers with an economic incentive to take part in the wholesale market will drive the smart grid.” By basically placing demand response in an equal position to a power generator, Wellinghoff said “by doing that, we're creating a market for this product that is the killer app for the smart grid. DR creates a more efficient grid and allows consumers to control and, in some cases, lower their bills. When you combine those two things together you've got a very powerful engine that can make the smart grid start and sustain itself.”

Earlier this year, Pike Research, lead by founder and managing director Clint Wheelock, identified six smart grid applications that “will change the way people use, buy, manage, and think about electricity” in its report "Smart Grid Apps: Six Trends That Will Shape Grid Evolution". This report was released earlier this year and the six smart grid apps focus on: 1) home energy management systems, 2) electric vehicles, 3) distribution automation, 4) smart-grid analytics, 5) building energy management systems, and 6) carbon management. Now we have lots of killer apps.

And this week at GridWeek, Michael Smith from Utility Analytics Institute organized a breakfast meeting with a panel consisting of Chuck Newton from Newton-Evans, Marty Rosenberg from EnergyBiz, Kate Rowland from Intelligent Utility Magazine, and Howard Scott from Cognyst Advisors. It was an interesting panel and the discussion moved to the challenge of managing data. Michael summed up the breakfast by saying that he thinks that the killer smart grid app is intelligent asset management.

My conclusion – there is not one single killer app. Demand response, including home energy management and building management will have a growing impact. EVs will also be a game changer and managing EV charging will be a part of demand response. Reliability and efficiency are driving distribution automation. I agree that smart grid analytics, especially applied to intelligent asset management will be a killer app. The industry needs a killer app to address aging infrastructure – both the assets and the people now maintaining these assets. Carbon management may be a killer app in Europe, but does not have the same level of attention in North America. Finally, no one mentioned energy storage, the killer app I might pick if I only had one choice. Energy storage decouples power generation from consumption which completely changes the landscape.

Friday, September 9, 2011

Smart grid in Europe: what can we learn about customer engagement?

“While the majority of national markets in Europe are advancing smart grid goals, few if any have meaningfully engaged the end-consumer,” according to the study’s lead author, Jan van der Zanden.

This comment points to the European focus (so far) on more utility-side applications while the smart grid enterprise in the US has largely been characterized by smart metering, home automation and other customer-facing applications. However, despite this focus, American utilities have had limited success, for example, in getting customers to sign up for demand response programs.

So, the Europeans might have a look at what their US counterparts have done, but what might be even more interesting is to see if any of them score successes that could be replicated in North America.

I’m thinking in particular of the conundrum in which the residential customers who represent the greatest potential for energy and costs savings are the ones for whom the “save money” argument is least effective. To put it more bluntly, if you live in a 5,000 square foot home, chances are the monthly electricity bill is not a major expense. Given how reluctant we humans are to change our behavior, the question becomes how to motivate these customers on the basis of something other than simple financial gain.

If our European colleagues find a solution to this one, it would be well worth importing.

Thursday, September 1, 2011

Smart Grid Update

Discussions continue on what smart grid is, what the drivers are, and how we create value. Enrique Santacana, President and CEO, ABB Inc. and ABB Region Manager of North America, recently summarized the smart grid drivers that we see in a Views from the Top article in the June 2011 issue of NEMA electroindustry. He focused on capacity, reliability, efficiency, sustainability, and customer engagement and then identified grid interoperability as the key issue underlying smart grid solutions .

Locally, we have been working to promote the regional smart grid hub that has formed in Research Triangle area and across the state of North Carolina. A ”cleantech cluster” has been formed with a strong focus on the smart grid industry. I’ll be providing more information in future blogs on this initiative. Part of our involvement is the new Distribution Automation Center of Excellence that we will open in the fall and our collaboration with the NSF FREEDM Center – we are co-located on the NC State Centennial Campus making it easy for our centers to work together.

Some upcoming events that we are supporting – I’m at the Smart Grid Road Show in Montreal this week and will be at GridWeek in Washington DC in September.

For more information about what ABB is doing in smart grid, visit our smart grid web portal at www.abb.com/smartgrids.